In the near future, as the statistics show, the market for the stone industry and building materials is moving toward natural, green, and environmentally friendly materials. The global natural stone market size was estimated at USD 33,375.3 million. In 2020 it was expected to reach USD 50,465.1 million and in 2030 it will grow at a CAGR of 4.0%. Natural stone is minerals obtained in the mountains, including quartzite, slate, limestone, sandstone, marble, granite , etc. It is mainly used in residential and commercial floors and walls due to its durability, hardness, and attractive appearance. It can be used for furniture, statues, and monuments.

Global natural building stones growth is driven by increased investment in the housing sector, expansion of the construction industry, and increased construction spending in several countries, including the United States, Japan, India, and others. In addition, increasing urbanization and population growth are expected to increase the demand for natural stone, flooring, and wall applications, driving the growth of the global market. The advantages associated with natural stone, such as durability, aesthetics, and reliability, have in turn boosted the use of slate and limestone in commercial and residential construction, thereby accelerating the growth of the global natural stone market.

Natural stone market

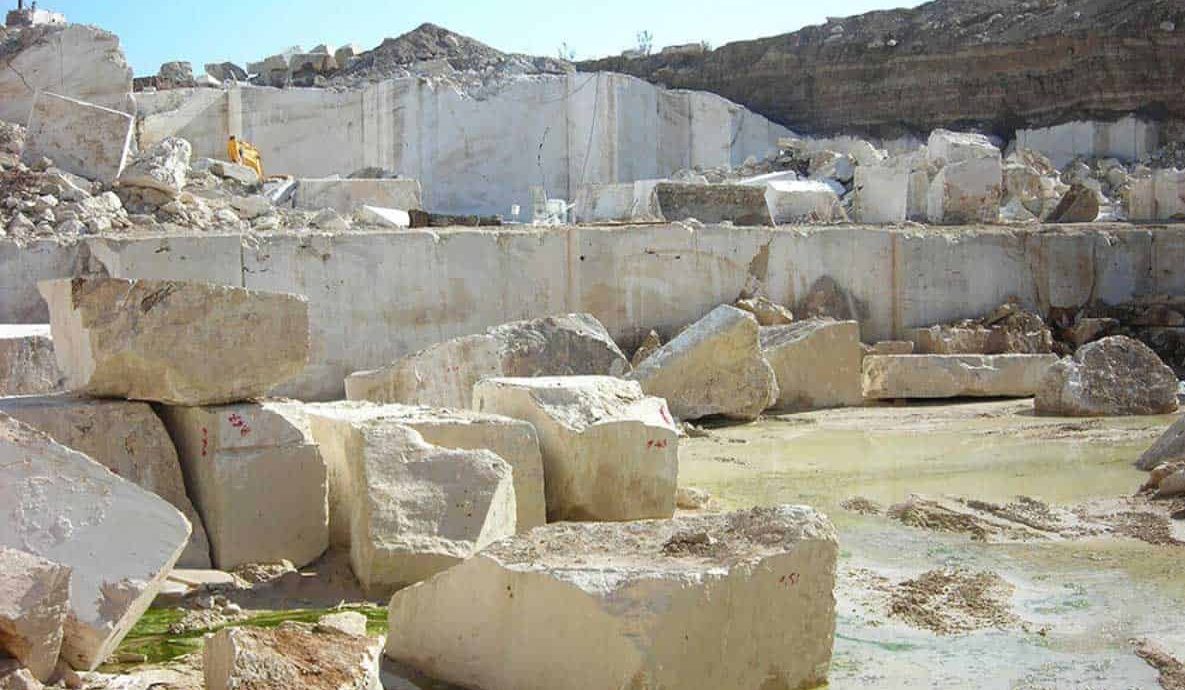

Natural stone is one of the most sustainable, environmentally friendly and non-toxic building materials. Therefore, it is the preferred building material in the market for people to choose green materials. It is a substance obtained from mountains and includes common stones such as sandstonetile , granite, travertine, limestone, onyx, slate, adoquin, marble, quartz, etc. It is available in a variety of colors and sizes with different physical and chemical properties. Natural stone is one of the basic building materials used to build dams, plants, arches, walls, and other structures. As the name suggests, they can be obtained naturally through mining and underground quarrying. Natural stone is widely used in institutional and monumental buildings. In addition, they are used as aggregates in concrete and masonry for channel walls and bridge piers. Rapid urbanization and the increase in the use of natural stone as interior flooring in architectural structures such as temples, mansions, government buildings, and schools are driving the growth of the market.

In addition, increasing awareness of outdoor entertainment areas and home improvement spending propensity is driving the growth of the global natural stone market. In addition, increasing public spending on new construction and renovation activities across the globe is driving the growth of the global natural stone market. For example, in August 2019, Canada’s federal government planned to invest approximately $180 billion in new infrastructure. Additionally, increasing disposable income of people in developing countries such as India, Brazil, Africa, etc. has led to increased expenditure on renovation activities, thereby accelerating the growth of the global natural stone market. For example, disposable income in South Africa is expected to grow by more than 1.5% from 2020 to 2022. However, increasing emphasis on the utilization of green and environment-friendly materials is hampering the growth of the market. On the other hand, developing economies in the Asia Pacific and LAMEA continue to offer lucrative growth opportunities for natural stone manufacturers due to the increase in investment in residential construction in these regions.

Natural stone industry statistics

The natural stoned tiles highly depends on the construction industry. As the statistics show, home improvement and maintenance spending is expected to continue to grow strongly in the coming year, according to the Leading Indicators of Remodeling Activity (LIRA), released by Harvard University’s Joint Center for Housing Research’s Remodeling Futures Program. LIRA expects annual improvement and repair spending to grow 9% year over year in the fourth quarter and maintain this pace through 2022. “Home renovations continue to benefit from a strong housing market with increased construction and sales activity and significant price increases in the national market,” said Carlos Martín, project director of the Center’s Renovation Future Project. “With this tailwind, homeowners could spend $400 billion in annual improvements and repairs by the third quarter of 2022,” said Abbe Will, associate program director for Retrofit Futures.  “However, there are still headwinds that could dampen the expected increase in retrofit costs, including higher labor and construction material costs, as well as higher interest rates.” A year after the pandemic brought unprecedented changes to the US economy, many economic indicators show extreme percentage changes from the lows triggered by the pandemic. To reduce the large swings in the growth rate created by these year-over-year comparisons, the 2022-Q2 and -Q3 forecasts use smoothed data from three main model inputs: Residential Redevelopment Permits, Single-Family Home Starts, and Existing Single-Family Home Sales.ston Using unsmoothed inputs in the LIRA model, the implausible annual growth rate is expected to be approximately two-thirds higher than reported. The Remodeling Futures program will continue to monitor input volatility.

“However, there are still headwinds that could dampen the expected increase in retrofit costs, including higher labor and construction material costs, as well as higher interest rates.” A year after the pandemic brought unprecedented changes to the US economy, many economic indicators show extreme percentage changes from the lows triggered by the pandemic. To reduce the large swings in the growth rate created by these year-over-year comparisons, the 2022-Q2 and -Q3 forecasts use smoothed data from three main model inputs: Residential Redevelopment Permits, Single-Family Home Starts, and Existing Single-Family Home Sales.ston Using unsmoothed inputs in the LIRA model, the implausible annual growth rate is expected to be approximately two-thirds higher than reported. The Remodeling Futures program will continue to monitor input volatility.

Building stone market

Granite is the leading natural building stone type on the market, mainly produced in countries such as Brazil, India, China, Spain and Saudi Arabia. The developing countries of China, India and Brazil together account for a large part of global granite production and export large quantities of granite to the United States, one of the largest consumer markets. Italy is also one of the rich sources of well-textured marble deposits, while China is a major producer of marble. The growth of the market is mainly driven by the growing construction market, especially in the Asia Pacific region. Construction activity in the region is increasing due to the development of the infrastructure sector and increasing disposable income of consumers. The construction industry in the region has also been strengthened by urbanization. The industry is driven by the growing construction and infrastructure sectors.  Rising consumer disposable income has helped the construction industry, especially in developing countries such as China and India. The increasing urbanization in these regions is further driving the market growth. Rising demand for residential, commercial and public infrastructure is also further driving the growth of the market. In many regions, especially North America, it is non-residential construction, such as construction of office, residential and public safety sectors driving the growth in market demand. In Asia Pacific, the construction industry will be driven by the increasing demand for infrastructure, especially for medical facilities and hospitals. Factors such as government initiatives and plans and foreign direct investment will further drive market growth in the business segment thereby contributing to the growth of the building blocks industry. The Asia Pacific region is also driving the growth of the global market due to increasing urbanization and increasing purchasing power of consumers. Product differentiation and its durability further drive the building block industry. The shift in consumer preference from other building materials to natural stone is also an important growth driver increasing the demand for building stone across regions.

Rising consumer disposable income has helped the construction industry, especially in developing countries such as China and India. The increasing urbanization in these regions is further driving the market growth. Rising demand for residential, commercial and public infrastructure is also further driving the growth of the market. In many regions, especially North America, it is non-residential construction, such as construction of office, residential and public safety sectors driving the growth in market demand. In Asia Pacific, the construction industry will be driven by the increasing demand for infrastructure, especially for medical facilities and hospitals. Factors such as government initiatives and plans and foreign direct investment will further drive market growth in the business segment thereby contributing to the growth of the building blocks industry. The Asia Pacific region is also driving the growth of the global market due to increasing urbanization and increasing purchasing power of consumers. Product differentiation and its durability further drive the building block industry. The shift in consumer preference from other building materials to natural stone is also an important growth driver increasing the demand for building stone across regions.

Stone fabrication industry

First, before we go any further, the word “fabricator” and fabrication industry need to be more clearly defined to better distinguish it from other businesses that are also involved in the natural stone industry. For the purposes of this article, “manufacturer” refers to those companies whose original “raw material” is usually slab, whether marble or granite or any other stone. Manufacturers should not be understood as those who use block cutters, multi-wire machines, or hacksaws to machine blocks into slabs in the factory, although some companies tend to control internally from block to slab to cut the size of the entire value chain. Another point of clarification – while the natural stone and crystal stone industry is fragmented around the world, usually consisting of small companies almost everywhere, the structure of the industry can vary from country to country, depending on a number of factors that cannot be enumerated here. Producers are usually small in size compared to quarry owners or factories.  In fact, in the vast majority of the world, they are usually small family-owned businesses employing roughly 2 or 3 people in developed countries, maybe 15 or 20. In recent decades, manufacturers have played a very crucial role in the stone industry. They have been the “face” of the world’s natural stone industry for the past three years, with the majority of end consumers dealing with the industry when they need to install a new kitchen countertop, overhaul a home, or even do small projects, manufacturers will provide installation services Manufacturers have always considered themselves traders with the ability to influence end consumers by telling them which type of natural stone best suits their specific needs. Whether it’s a kitchen shop owner with a client looking to remodel a kitchen, a homeowner or an interior designer doing some renovation work, the manufacturer’s opinion and expertise are valued. After all, he is an expert in a dizzyingly complex industry with many different criteria to consider before deciding which stone to use.

In fact, in the vast majority of the world, they are usually small family-owned businesses employing roughly 2 or 3 people in developed countries, maybe 15 or 20. In recent decades, manufacturers have played a very crucial role in the stone industry. They have been the “face” of the world’s natural stone industry for the past three years, with the majority of end consumers dealing with the industry when they need to install a new kitchen countertop, overhaul a home, or even do small projects, manufacturers will provide installation services Manufacturers have always considered themselves traders with the ability to influence end consumers by telling them which type of natural stone best suits their specific needs. Whether it’s a kitchen shop owner with a client looking to remodel a kitchen, a homeowner or an interior designer doing some renovation work, the manufacturer’s opinion and expertise are valued. After all, he is an expert in a dizzyingly complex industry with many different criteria to consider before deciding which stone to use.

Marble market

In the marble market, it is anticipated that the white segment will experience the highest growth rate over the course of the forecast period. The marble that is white in color can have a myriad of different tones, textures, and patterns available to choose from. White marble is an excellent choice for use in construction projects that call for an opulent and aesthetically pleasing appearance. White marble has been used to build monuments, statues, and grave markers, among other things, since ancient times. As a result of the growing need for residential and commercial infrastructure, it is anticipated that the building and construction sector will dominate the marble market in the year 2020.  Marble is used a lot in building and construction because it can be used on floors, walls, roofs, columns, and the outside of buildings. In addition, marble is one of the most popular natural ballasts tone used in the construction of residential and commercial structures, particularly in areas such as kitchens, restrooms, and exteriors. During the time frame of the forecast, the main thing that is expected to drive demand for marble is the growth of the construction industry in Asia and the Pacific. This includes both residential and commercial buildings. Between the years 2020 and 2025, it is anticipated that the market for marble in the Asia-Pacific region will expand at the greatest compound annual growth rate (CAGR). In 2019, China held the largest proportion of the worldwide marble market, which is one factor propelling the expansion of the Asia-Pacific region. During the time period covered by the prediction, the markets for marble in the Asia-Pacific area that show the most promise are China, India, Japan, and South Korea. The expansion can be attributed to the construction sector’s increasing need for marble to be used in the building of residential and commercial infrastructures, particularly in China and India.

Marble is used a lot in building and construction because it can be used on floors, walls, roofs, columns, and the outside of buildings. In addition, marble is one of the most popular natural ballasts tone used in the construction of residential and commercial structures, particularly in areas such as kitchens, restrooms, and exteriors. During the time frame of the forecast, the main thing that is expected to drive demand for marble is the growth of the construction industry in Asia and the Pacific. This includes both residential and commercial buildings. Between the years 2020 and 2025, it is anticipated that the market for marble in the Asia-Pacific region will expand at the greatest compound annual growth rate (CAGR). In 2019, China held the largest proportion of the worldwide marble market, which is one factor propelling the expansion of the Asia-Pacific region. During the time period covered by the prediction, the markets for marble in the Asia-Pacific area that show the most promise are China, India, Japan, and South Korea. The expansion can be attributed to the construction sector’s increasing need for marble to be used in the building of residential and commercial infrastructures, particularly in China and India.

Marble industry

Marble is one of the most popular sedimentary stones. This rock is the result of a metamorphic process. It is also the most widely used in the construction industry due to its high aesthetics and durability. In this article we will study this gem. At the same time, some of the most important properties of marble stone type are investigated. If you are also interested in this article; stay with Del Carve until the end. Marble is a family of metamorphic rocks. This stone is obtained from the transformation of limestone and a number of geological processes. In fact, to form marble, the limestone must first undergo high pressure and high temperature deep within the formation. By applying this high pressure and high temperature, most of the impurities and fossils left in the limestone will be destroyed. During this process, limestone gradually loses its properties and turns into marble.  The main constituent of marble usually includes calcite. This material is derived from calcium carbonate as well as dolomite and aragonite crystals. Interestingly, the composition of marble and its various colors come from impurities in natural lime. That is, the high pressure and high temperature to which the impurities in the marble source stone (tumbled limestone) are exposed will affect the color of the final marble. Marble has a crystalline texture and nature. It also has lower porosity than other stones, such as travertine. These two properties of marble make this stone less susceptible to water damage.

The main constituent of marble usually includes calcite. This material is derived from calcium carbonate as well as dolomite and aragonite crystals. Interestingly, the composition of marble and its various colors come from impurities in natural lime. That is, the high pressure and high temperature to which the impurities in the marble source stone (tumbled limestone) are exposed will affect the color of the final marble. Marble has a crystalline texture and nature. It also has lower porosity than other stones, such as travertine. These two properties of marble make this stone less susceptible to water damage.  However, the presence of calcium carbonate in the marble structure makes the stone highly reactive to acids. Therefore, acids and acidic solutions are one of the main factors in damaging marble. Other factors such as air temperature and temperature differences, atmospheric precipitation, and direct sunlight can also damage marble and shorten its life. Marble’s unique beauty and effectiveness have attracted people’s attention since ancient times. In addition to its beauty and high color diversity, this stone has other wonderful properties. Polishability and high ductility, as well as high quality and durability, encourage designers to use this stone.

However, the presence of calcium carbonate in the marble structure makes the stone highly reactive to acids. Therefore, acids and acidic solutions are one of the main factors in damaging marble. Other factors such as air temperature and temperature differences, atmospheric precipitation, and direct sunlight can also damage marble and shorten its life. Marble’s unique beauty and effectiveness have attracted people’s attention since ancient times. In addition to its beauty and high color diversity, this stone has other wonderful properties. Polishability and high ductility, as well as high quality and durability, encourage designers to use this stone.

Your comment submitted.